About Me

I'm an experienced student researcher with demonstrable inter-disciplinary research in the field of financial engineering, signals processing, statistical analysis, and machine learning. I possess the ability to provide innovative and efficient solutions for any engineering challenge and can adapt in any domain.Featured

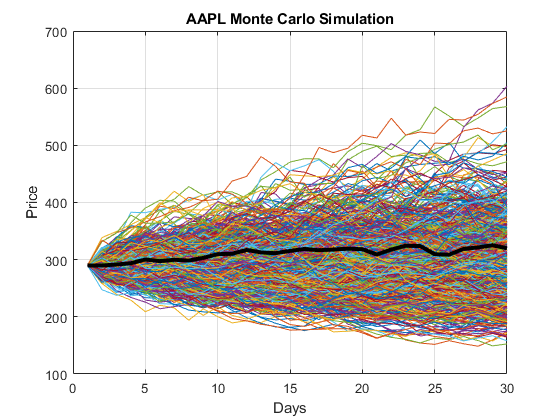

Asset Price Modelling using Monte-Carlo Simulations

An asset-price model using historical prices. Volatility of the asset is modeled as the random variable that changes over time and each iteration. For modelling the future price behavior, Monte Carlo simulations were performed. The method, with sufficient number of simulations and clean data, provides a frequency distribution curve that is guassian in nature for the most likely future price range estimate.

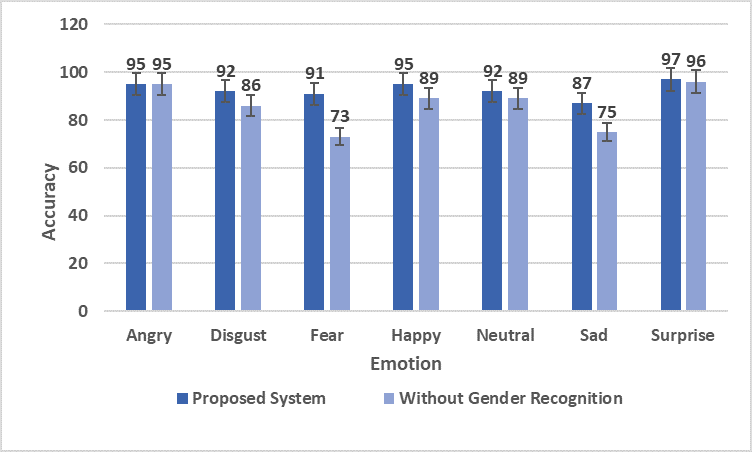

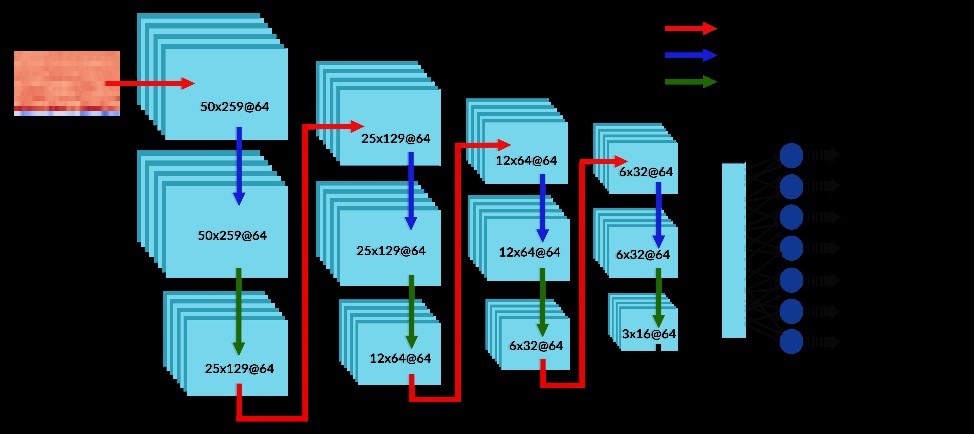

Gender Differentiated Convolutional Neural Networks for Speech Emotion Recognition

This paper proposes a two-stage gender-differentiated system for Speech Emotion Recognition using Mel-frequency Cepstral Coefficients and Convolutional Neural Network with Global Average Pooling. The provided solution can recognize seven emotions. Data augmentation is used to compensate for the lack of quality data. The system is composed of two stages: 1) gender classification and 2) emotion classification. The output of the gender classifier in the first stage determines classifier to be used in the second stage. The results demonstrate that the proposed system significantly improves performance.

Publications

Gender Differentiated Convolutional Neural Networks for Speech Emotion Recognition

THE 12TH INTERNATIONAL CONGRESS ON ULTRA MODERN TELECOMMUNICATIONS AND CONTROL SYSTEMS

This paper proposes a two-stage gender-differentiated system for Speech Emotion Recognition using Mel-frequency Cepstral Coefficients and Convolutional Neural Network with Global Average Pooling. The provided solution can recognize seven emotions. Data augmentation is used to compensate for the lack of quality data. The system is composed of two stages: 1) gender classification and 2) emotion classification. The output of the gender classifier in the first stage determines classifier to be used in the second stage. The results demonstrate that the proposed system significantly improves performance.

Skills & Technologies

Python/MATLAB/C++

Able to write modular code with OOP standards. End-to-end project management from ideation and development to deployment.

Machine Learning / Deep Learning

Tried and tested experience in the field of Regression, Classification, time-Series models, and Signals processing with frameworks such as Keras, Sci-Kit, and PySpark.

MySQL

Experienced in Database Management Systems such as MySQL and PL/SQL.

Statistics and Probability

Experienced in modelling using AR and MA models, Monte-Carlo simulations, curve fitting, and hypothesis testing.

Mathematical Modelling

Experienced in modelling using regression functions, deterministic, and stochastic models.

Financial Engineering

Ability to transform financial mathematics and models into interpretable and high performance programs.

Data Science/Analytics

Able to visualise, identify patterns and conduct Exploratory data anaylysis as well as confirmatory data analysis.

Corporate Finance

Well-versed with the basics of Corporate Finance, Equity Markets, and Derivative and Commodities Markets.

Signals Processing & Analysis

Adept at conceptualising, analysing, modifying, and synthesizing signals in the field of telecommunications, audio, and wireless radio communications. Experienced with 2G, 3G, 4G, VoLTE, and 5G technologies and their technology stacks.

Autonomous Vehicle Communications (5G)

Strong knowledge in DSRC protocols as well as 5G New Radio technology and Cognitive Radios aimed at enabling V2X communications.

Development Environments

Well-versed with Amazon Web Services, Google Colab, Github,VS Code, IBM Watson, and Jupyter Notebooks.

Front End Web Development

Basics of HTML, CSS, Javascript ES6. Currently learning ReactJS and Flask.

Experience

Research Assistant

Post Graduate Institute of Medical Education and Research, Chandigarh

Researched on an ICMR funded project to segment and classify brain strokes from CT images of a patient, as well as, in the field of retinal fundus images, Image processing and Neural Networks. Designed and implemented a Deep Learning based image segmentation model for stroke regions in a brain CT images.

Summer Internship

Ericsson India Pvt. Ltd., Indore

Automated daily data collection of Network statistics and KPIs for 2G, 3G, 4G & VoLTE technologies using data analysis tools and Python. Troubled BTS and cells could be identified and tracked in a more efficient manner while providing insights into causes.

Research & Projects

Asset Price Modelling using Monte-Carlo Simulations

An asset-price model using historical prices. Volatility of the asset is modeled as the random variable that changes over time and each iteration. For modelling the future price behavior, Monte Carlo simulations were performed. The method, with sufficient number of simulations and clean data, provides a frequency distribution curve that is guassian in nature for the most likely future price range estimate.

Asset Trading Strategy Optimization

Implemented an optimal trading strategy for procuring a large but fixed volume of a risky asset. The proposed approach splits a large block of trade into smaller packages to minimize the execution cost of the trade. The asset price is expressed as a convex combination of the price before our trade in the asset and the execution price carrying the impact of our prior trade in it. Applied regression techniques to estimate the unaffected price of the asset and formulated a convex quadratic optimization model.

Equity Closing Price Estimation Using LSTM and Technical Indicators

Developed a prediction model to estimate the closing price and direction of an exchange traded equity based on its 9 technical indicators namely: SMA, EMA, MACD, SO, ROI, WillR, ADX, MFI, AD.

Used a Long Short Term Memory network to model the data, obtained from Yahoo Finance APIs.

Investment Portfolio Optimization

Developed a simple MATLAB based program to calculate, compare, and visualise omega ratios for given historical returns of any number of companies.

V2X Channel Performance Evaluation using Monte-Carlo Simulations

Implemented a coding scheme for 802.11p standard to evaluate its performance under changing environment conditions pursuant to an actual V2X channel using 10,000 simulations.

Multi-Modal Speech Sentiment Analysis

Capstone Project on multi-modal sentiment analysis on audio signals using Natural Language Processing for text sentiment analysis and 2D Convolutional Neural Networks for speech emotion recognition. Implementation was done using Python utilising the Keras, Tensorflow and Sci-Kit Learn frameworks. Achieved an accuracy of 100% for gender classification and 97%/96% for female/male gender wise emotion classification.

Covid-19 Disease Spread Modelling Using ARIMA and Removal of Residual Errors Using LSTM Networks

Developed a hybrid model of ARIMA for estimation of COVID-19 disease spread in India and denoising of residual errors using a Recurrent Neural Network.

PyPI Data Distribution Package

Created a Python Package published on PyPI for calculating a Binomial and Gaussian distribution classes, performing mathematical & statistical operations, and visualizing them.

Spectrum Sensing for Cognitive Radios Using Residual Neural Networks

Developed a simple MATLAB based program to calculate, compare, and visualise omega ratios for given historical returns of any number of companies.

IBM Watson Based Prediction of Buying Behavior of Consumers

Built a machine learning model in the IBM Watson Studio to predict clients' interests in terms of product line using Random Forests classifier while using Apache Spark’s pipelines.

Classification of Ionosphere Data using Extreme Gradient Boosted Random Forests

Developed a classifier for the JHU Ionosphere Database using Extreme Gradient Boosted Random Forests. The model achieved 96.8% accuracy, higher than KNN.

Vaayu

Designed and implemented an IoT based mesh network consisting of multiple air pollution with ML Algorithms to predict pollution levels and disseminate information via App/website.

CSMA/CA In Dedicated Short Range Communication Systems

Implemented the DSRC based 802.11 family of Carrier Sense Multiple Access with Collision Avoidance (CSMA-CA) protocol using MATLAB. Highlighted and discovered the problems associated with this approach of multiple access and its shortcomings.

V2X Communication using DSRC protocols

Researched and simulated V2X communication scenarios based on DSRC protocols and the IEEE 802.11p technology stack in MATLAB.

Random-Valued Impulse Noise Removal Using Hybrid Median Filter

Researched and designed a novel algorithm based on a hybrid median filter to remove random-valued impulse noise from digital images using image processing.

Thapar Satellite Project

Member of the On-Board Computer Team of the Student Satellite Program of TIET with the aim to design and develop a nano-satellite capable of monitoring the infra-red Spectrum and environmental greenhouse gases.

Front-End Web Development

Designed and maintained the website for the college society, Thapar MUN Society

VEPS Stroke Detection

Conceptualised and Engineered a device based on Volumetric Electromagnetic Phase-Shift Spectroscopy technology to detect and classify brain strokes, thus speeding up the diagnosis process and lowering the costs.

Contact Me

If you wish to colloborate on a research project or just ask a question, you can drop me an email at,pmishra_be17@thapar.edu